AccurateLeads conducted recent research that compared eight of the most prominent direct mail vendors in the United States. The results were eye opening. When building a mailing list there are a number of factors that need to be taken into account. What happens when the all of these factors are the same across the board, but the one difference is the source the list comes from? While some deviation is expected, the research reflected a degree of change that was astounding. AccurateLeads discloses recent findings comparing mailing lists among eight of the country’s most used list vendors.

AccurateLeads conducted recent research that compared eight of the most prominent direct mail vendors in the United States. The results were eye opening. When building a mailing list there are a number of factors that need to be taken into account. What happens when the all of these factors are the same across the board, but the one difference is the source the list comes from? While some deviation is expected, the research reflected a degree of change that was astounding. AccurateLeads discloses recent findings comparing mailing lists among eight of the country’s most used list vendors.

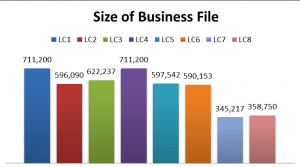

For the sake of anonymity the list providers will be referred to as LP1 through LP8. AccurateLeads ran a number of counts for varying lists, but this example is a business count ran in mid-October across the state of Georgia that was selected with the exact same demographic, geographic, and quality factors. The follow are the results from each vendor: LP1 711,200 – LP2 596,090 – LP3 622,237 – LP4 711,200 – LP5 597,542 – LP6 590,153 – LP7 345,217 – LP8 358,750. There is a standard deviation of 132,054.7 and the largest file has 365,983 more records than the smallest file. This amount of change between counts would be considered large on any scale.

Why is there such a vast change among the counts when all of the same criteria were selected? Every list vendor has different compilation methods, and once the data is in house various cleansing methods take place which will change the counts. Many people would assume that the list provider with the highest count has the best file but this is rarely the case. The business with the lowest count does not necessarily have the most precise records. The obvious ideal is a medium where vendors provide the most records with completely clean data. Companies are constantly going out business, relocating, and changing their structure, so the files largely depend on the company’s collection and cleansing methods.

While this is one example, AccurateLeads’s research has indicated that these principles hold true across all types of mailing lists whether it is a consumer, business, or a specialty request. When a list vendor is experienced they should know which resources to use during the compilation process and also clean the file prior to submittal to the buyer. The research also indicated that the list vendors had strengths within various criteria selections. For example, LP3 had better records than LP5 in SIC 02 which is agricultural production (Livestock and Animal Specialties) and LP5 had better records than LP3 in SIC 48 which is communication industries. Each provider has areas where they excel and areas where they have an inferior product. It is important for business owners to ask questions like, “how do you compile your data” and “do you clean the files in house” so that the best list is attained. With such a large degree of variance among vendors it can seem difficult to find a quality provider, but with a small amount of research this can be achieved.